Introduction

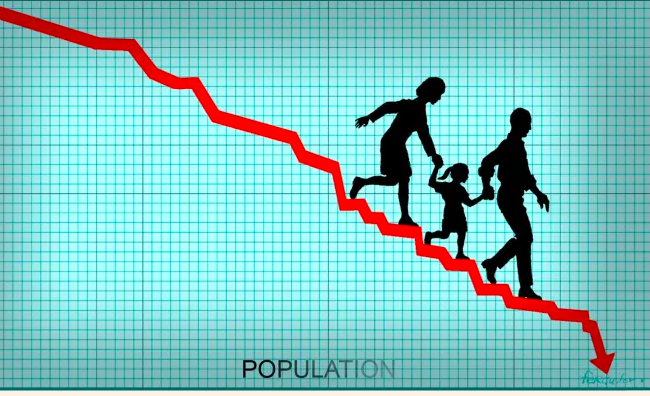

India’s population, with its impressive diversity and cultural richness, is also accompanied by significant challenges, one of which is overpopulation. In an era where financial stability is crucial for a decent quality of life, the consequences of having more than two children in India have far-reaching implications on family finances. This article explores the intersection between overpopulation and financial crisis, shedding light on the economic factors at play.

The Economic Burden of Overpopulation:

1. Increased Household Expenditures:

With each new addition to the family, household expenditures rise substantially. Costs associated with education, healthcare, nutrition, clothing, and housing multiply, often outstripping the ability of families to provide adequately for each member.

2. Education Struggles:

Providing a quality education for children is a significant financial commitment. As families expand, ensuring every child’s access to education becomes progressively challenging. Limited resources may force families to compromise on the quality of education, limiting the potential for socio-economic mobility.

3. Healthcare Costs:

The cost of healthcare is a major concern, particularly in a country where medical expenses can be significant. More children mean higher healthcare expenses, including vaccinations, routine check-ups, and unforeseen medical emergencies.

4. Impact on Savings and Retirement Planning:

Overpopulation can jeopardize parents’ ability to save for the future. With each child, the capacity to save for retirement diminishes, potentially leaving parents financially vulnerable during their later years.

5. Unemployment and Job Market Pressure: :

The growing population intensifies competition in the job market, making it harder for parents to secure stable employment. As more individuals enter the workforce, the potential for unemployment or underemployment rises, hampering income stability.

Stunning News: Global population could peak at 9.7 billion by 2063.

Government Initiatives and Awareness:

To address these challenges, the Indian government has introduced various initiatives to encourage family planning and smaller family sizes. Awareness campaigns, subsidies on family planning methods, and educational programs emphasize the advantages of smaller families, including improved financial stability.

1. Family Planning Programs:

The government promotes access to contraceptives and family planning services to empower couples to make informed decisions about the size of their families.

2. Incentives for Small Families:

Some states offer financial incentives or benefits to families with fewer children, encouraging them to limit their family size. These incentives may include access to better healthcare facilities, education opportunities, and reduced taxes.

3. Advocacy and Education:

Public awareness campaigns focus on educating individuals and families about the economic benefits of having fewer children. These campaigns emphasize the link between smaller families and improved financial well-being.

Conclusion

The connection between overpopulation and financial crisis underscores the importance of family planning and responsible reproductive choices. While cultural and societal factors play a role in family size decisions, understanding the financial implications is equally crucial. By promoting awareness, improving access to family planning resources, and offering incentives for smaller families, India aims to mitigate the economic strain of overpopulation and create a path towards a more financially stable future for its citizens.

Sources – Web Research

Thanks